Gift Tax in Japan: A Comprehensive Guide

Win a Free Trip to Japan!

Experience cherry blossoms and ancient temples

Wondering about the ins and outs of gift tax in Japan? Look no further. This guide will help you navigate the complexities of Japan’s gift tax system and answer all your burning questions.

Understanding Gift Tax in Japan

In Japan, gift tax is imposed on the recipient of a gift, not the giver. The tax rate varies depending on the relationship between the giver and recipient, and the value of the gift.

Gift Tax Exemptions

Certain types of gifts are exempt from gift tax, including:

- Gifts between spouses

- Gifts from grandparents to grandchildren

- Gifts for educational or medical purposes

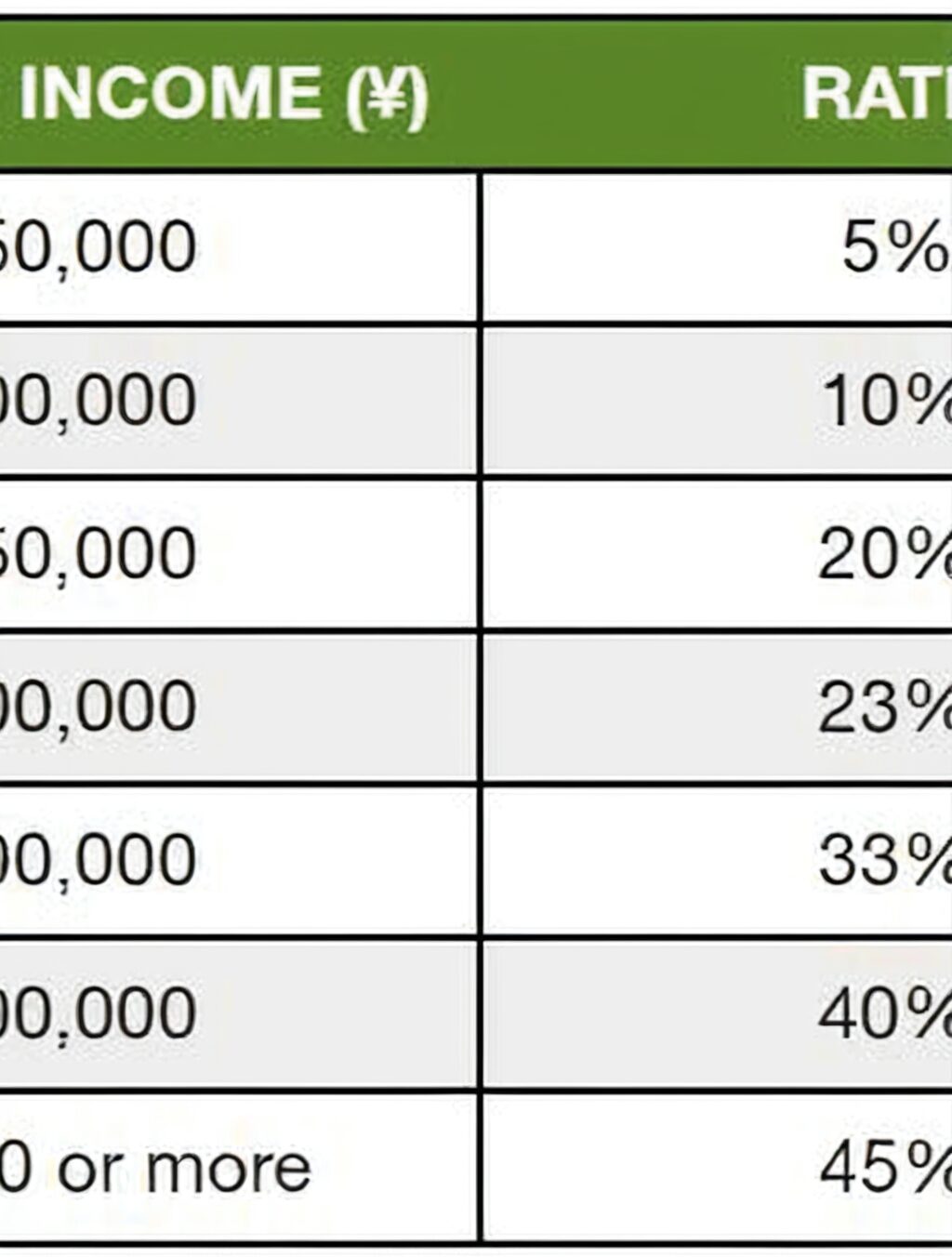

Gift Tax Rates

For gifts between non-relatives, the gift tax rate is a progressive scale ranging from 10% to 55%. The tax rate is determined by the value of the gift and the recipient’s annual income.

Gift Tax for Spouses

Gifts between spouses are tax-free. However, if the spouses are not Japanese citizens or residents, the gift may be subject to gift tax.

FAQs

- How is the value of a gift determined? The value of a gift is determined based on its fair market value at the time of the gift.

- Are there any other taxes that may apply to gifts? In addition to gift tax, inheritance tax may also apply to gifts received within three years of the giver’s death.

- What are the penalties for not paying gift tax? Failure to pay gift tax can result in fines and imprisonment.

Conclusion

Understanding gift tax in Japan is crucial to avoid any unexpected tax liabilities. By familiarizing yourself with the exemptions, rates, and penalties, you can ensure that your gift-giving is both meaningful and tax-efficient.

gift tax in japan

Gift Tax in Japan for Foreigners: A Comprehensive Guide

As a foreigner living in Japan or planning to gift someone in Japan, understanding the gift tax implications is essential. This guide will provide you with all the information you need to navigate Japan’s gift tax system and avoid any unexpected tax liabilities.

Understanding Gift Tax in Japan

In Japan, gift tax is imposed on the recipient of a gift, not the giver. The tax rate and exemptions vary depending on the relationship between the giver and recipient, as well as the value of the gift.

Gift Tax for Foreigners

Foreigners are subject to the same gift tax rates and exemptions as Japanese citizens. However, there are a few additional considerations for foreigners to keep in mind:

- Gifts from non-residents are taxable if the recipient is a Japanese resident.

- Gifts received from abroad may be subject to customs duties.

Gift Tax Calculator

To estimate the amount of gift tax you may owe, you can use the Japan Tax Agency’s gift tax calculator (available in Japanese only).

How to Avoid Gift Tax in Japan

There are a few strategies you can use to reduce or avoid gift tax in Japan:

- Take advantage of the gift tax exemptions.

- Make gifts in smaller amounts over time.

- Give gifts that are not easily valued, such as experiences or services.

FAQs

- What are the penalties for not paying gift tax? Failure to pay gift tax can result in fines and imprisonment.

- Can I get a refund on gift tax if I return the gift? Yes, you can get a refund if you return the gift within one year of receiving it.

- Where can I get more information about gift tax in Japan? You can visit the Japan Tax Agency’s website or consult with a tax professional.

Conclusion

Understanding gift tax in Japan is crucial for foreigners to avoid any tax surprises. By familiarizing yourself with the rules and exemptions, you can ensure that your gift-giving is both meaningful and tax-efficient.

is there gift tax in japan

Japanese Gift Tax Rates: A Comprehensive Guide

Planning to give a gift to someone in Japan? Understanding the gift tax rates is essential to avoid any unexpected tax liabilities. This guide will provide you with all the information you need to know about Japanese gift tax rates and how they apply to different types of gifts.

Understanding Japanese Gift Tax Rates

In Japan, gift tax is imposed on the recipient of a gift, not the giver. The tax rate varies depending on the relationship between the giver and recipient, as well as the value of the gift.

Gift Tax Rates for Different Relationships

The gift tax rates in Japan are as follows:

- Spouse: 0%

- Lineal descendants (children, grandchildren, etc.): 10-20%

- Siblings: 15-30%

- Other relatives: 20-40%

- Non-relatives: 50-55%

Gift Tax Exemptions

Certain types of gifts are exempt from gift tax, including:

- Gifts between spouses

- Gifts from grandparents to grandchildren

- Gifts for educational or medical purposes

- Gifts of up to 1.1 million yen per year

Japanese Inheritance and Gift Tax Reform

In 2015, Japan introduced a major inheritance and gift tax reform. The reform increased the gift tax rates for non-relatives and reduced the lifetime gift tax exemption.

FAQs

- How is the value of a gift determined? The value of a gift is determined based on its fair market value at the time of the gift.

- Are there any other taxes that may apply to gifts? In addition to gift tax, inheritance tax may also apply to gifts received within three years of the giver’s death.

- What are the penalties for not paying gift tax? Failure to pay gift tax can result in fines and imprisonment.

Conclusion

Understanding Japanese gift tax rates is crucial to avoid any tax surprises. By familiarizing yourself with the rates and exemptions, you can ensure that your gift-giving is both meaningful and tax-efficient.

gift tax exemption japan

Gift Tax in Japan: A Comprehensive Guide

In Japan, gift tax is imposed on the recipient of a gift, not the giver. The tax rate and exemptions vary depending on the relationship between the giver and recipient, as well as the value of the gift.

Gift Tax Rates

The gift tax rates in Japan are as follows:

- Spouse: 0%

- Lineal descendants (children, grandchildren, etc.): 10-20%

- Siblings: 15-30%

- Other relatives: 20-40%

- Non-relatives: 50-55%

Gift Tax Exemptions

Certain types of gifts are exempt from gift tax, including:

- Gifts between spouses

- Gifts from grandparents to grandchildren

- Gifts for educational or medical purposes

- Gifts of up to 1.1 million yen per year

FAQs

- How is the value of a gift determined? The value of a gift is determined based on its fair market value at the time of the gift.

- Are there any other taxes that may apply to gifts? In addition to gift tax, inheritance tax may also apply to gifts received within three years of the giver’s death.

- What are the penalties for not paying gift tax? Failure to pay gift tax can result in fines and imprisonment.

Conclusion

Understanding gift tax in Japan is crucial to avoid any tax surprises. By familiarizing yourself with the rates and exemptions, you can ensure that your gift-giving is both meaningful and tax-efficient.